With the popularization and application of new energy batteries such as lithium manganate batteries, their manganese-based positive materials have attracted much attention. Based on relevant data, the market research department of UrbanMines Tech. Co., Ltd. summarized the development status of China’s manganese industry for the reference of our customers.

1. Manganese supply: The ore end relies on imports, and the production capacity of processed products is highly concentrated.

1.1 Manganese industry chain

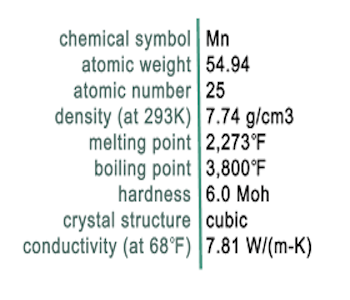

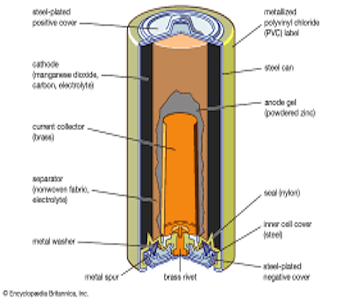

Manganese products are rich in variety, mainly used in steel production, and have great potential in battery manufacturing. Manganese metal is silvery white, hard and brittle. It is mainly used as a deoxidizer, desulfurizer and alloying element in the steelmaking process. Silicon-manganese alloy, medium-low carbon ferromanganese and high-carbon ferromanganese are the main consumer products of manganese. In addition, manganese is also used in the production of ternary cathode materials and lithium manganate cathode materials, which are application areas with great potential for future growth. Manganese ore is mainly utilized through metallurgical manganese and chemical manganese. 1) Upstream: Ore mining and dressing. Manganese ore types include manganese oxide ore, manganese carbonate ore, etc. 2) Midstream processing: It can be divided into two major directions: chemical engineering method and metallurgical method. Products such as manganese dioxide, metallic manganese, ferromanganese and silicomanganese are processed through sulfuric acid leaching or electric furnace reduction. 3) Downstream applications: Downstream applications cover steel alloys, battery cathodes, catalysts, medicine and other fields.

1.2 Manganese ore: high-quality resources are concentrated overseas, and China relies on imports

Global manganese ores are concentrated in South Africa, China, Australia and Brazil, and China’s manganese ore reserves rank second in the world. Global manganese ore resources are abundant, but they are unevenly distributed. According to Wind data, as of December 2022, the world’s proven manganese ore reserves are 1.7 billion tons, 37.6% of which are located in South Africa, 15.9% in Brazil, 15.9% in Australia, and 8.2% in Ukraine. In 2022, China’s manganese ore reserves will be 280 million tons, accounting for 16.5% of the world’s total, and its reserves will rank second in the world.

The grades of global manganese ore resources vary greatly, and high-quality resources are concentrated overseas. Manganese-rich ores (containing more than 30% manganese) are concentrated in South Africa, Gabon, Australia and Brazil. The grade of manganese ore is between 40-50%, and the reserves account for more than 70% of the world’s reserves. China and Ukraine mainly rely on low-grade manganese ore resources. Mainly, the manganese content is generally less than 30%, and it needs to be processed before it can be utilized.

The world’s major manganese ore producers are South Africa, Gabon and Australia, with China accounting for 6%. According to wind, global manganese ore production in 2022 will be 20 million tons, a year-on-year decrease of 0.5%, with overseas accounts for more than 90%. Among them, the output of South Africa, Gabon and Australia is 7.2 million, 4.6 million and 3.3 million tons respectively. China’s manganese ore output is 990,000 tons. It accounts for only 5% of global production.

The distribution of manganese ore in China is uneven, mainly concentrated in Guangxi, Guizhou and other places. According to “Research on China’s Manganese Ore Resources and Industrial Chain Security Issues” (Ren Hui et al.), China’s manganese ores are mainly manganese carbonate ores, with smaller amounts of manganese oxide ores and other types of ores. According to the Ministry of Natural Resources, China’s manganese ore resource reserves in 2022 are 280 million tons. The region with the highest manganese ore reserves is Guangxi, with reserves of 120 million tons, accounting for 43% of the country’s reserves; followed by Guizhou, with reserves of 50 million tons, accounting for 43% of the country’s reserves. 18%.

China’s manganese deposits are small in scale and of low grade. There are few large-scale manganese mines in China, and most of them are lean ores. According to “Research on China’s Manganese Ore Resources and Industrial Chain Security Issues” (Ren Hui et al.), the average grade of manganese ore in China is about 22%, which is low grade. There are almost no rich manganese ores that meet international standards, and low-grade lean ores require It can only be used after improving the grade through mineral processing.

China’s manganese ore import dependence is about 95%. Due to the low grade of China’s manganese ore resources, high impurities, high mining costs, and strict safety and environmental protection controls in the mining industry, China’s manganese ore production has been declining year by year. According to data from the U.S. Geological Survey, China’s manganese ore production has been in decline in the past 10 years. Production dropped significantly from 2016 to 2018 and 2021. The current annual production is about 1 million tons. China relies heavily on imports of manganese ore, and its external dependence has been above 95% in the past five years. According to Wind data, China’s manganese ore output will be 990,000 tons in 2022, while imports will reach 29.89 million tons, with an import dependence as high as 96.8%.

1.3 Electrolytic manganese: China accounts for 98% of global production and production capacity is concentrated

China’s electrolytic manganese production is concentrated in the central and western provinces. China’s electrolytic manganese production is mainly concentrated in Ningxia, Guangxi, Hunan and Guizhou, accounting for 31%, 21%, 20% and 12% respectively. According to the Steel Industry, China’s electrolytic manganese production accounts for 98% of global electrolytic manganese production and is the world’s largest producer of electrolytic manganese.

China’s electrolytic manganese industry has concentrated production capacity, with Ningxia Tianyuan Manganese Industry’s production capacity accounting for 33% of the country’s total. According to Baichuan Yingfu, as of June 2023, China’s electrolytic manganese production capacity totaled 2.455 million tons. The top ten companies are Ningxia Tianyuan Manganese Industry, Southern Manganese Group, Tianxiong Technology, etc., with a total production capacity of 1.71 million tons, accounting for the country’s total production capacity 70%. Among them, Ningxia Tianyuan Manganese Industry has an annual production capacity of 800,000 tons, accounting for 33% of the country’s total production capacity.

Affected by industry policies and power shortages, electrolytic manganese production has declined in recent years. In recent years, with the introduction of China’s “double carbon” goal, environmental protection policies have become stricter, the pace of industrial upgrading has accelerated, backward production capacity has been eliminated, new production capacity has been strictly controlled, and factors such as power restrictions in some areas have limited production, the output in 2021 has dropped. In July 2022, the Manganese Specialized Committee of the China Ferroalloy Industry Association issued a proposal to limit and reduce production by more than 60%. In 2022, China’s electrolytic manganese output fell to 852,000 tons (yoy-34.7%). In October 22, the Electrolytic Manganese Metal Innovation Working Committee of the China Mining Association proposed the goal of halting all production in January 2023 and 50% of production from February to December. In November 22, the Electrolytic Manganese Metal Innovation Working Committee of the China Mining Association recommended that enterprises We will continue to suspend production and upgrade, and organize production at 60% of production capacity. We expect that electrolytic manganese output will not increase significantly in 2023.

The operating rate remains at around 50%, and the operating rate will fluctuate greatly in 2022. Affected by the alliance plan in 2022, the operating rate of China’s electrolytic manganese companies will fluctuate greatly, with the average operating rate for the year being 33.5%. Production suspension and upgrade were carried out in the first quarter of 2022, and the operating rates in February and March were only 7% and 10.5%. After the alliance held a meeting at the end of July, factories in the alliance reduced or suspended production, and the operating rates in August, September and October were less than 30%.

1.4 Manganese dioxide: Driven by lithium manganate, production growth is rapid and production capacity is concentrated.

Driven by the demand for lithium manganate materials, China’s electrolytic manganese dioxide production has increased significantly. In recent years, driven by the demand for lithium manganate materials, the demand for lithium manganate electrolytic manganese dioxide has increased significantly, and China’s production has subsequently increased. According to “A Brief Overview of Global Manganese Ore and China’s Manganese Product Production in 2020″ (Qin Deliang), China’s electrolytic manganese dioxide production in 2020 was 351,000 tons, a year-on-year increase of 14.3%. In 2022, some companies will suspend production for maintenance, and the output of electrolytic manganese dioxide will decline. According to data from Shanghai Nonferrous Metal Network, China’s electrolytic manganese dioxide output in 2022 will be 268,000 tons.

China’s electrolytic manganese dioxide production capacity is concentrated in Guangxi, Hunan and Guizhou. China is the world’s largest producer of electrolytic manganese dioxide. According to the Huajing Industrial Research Institute, China’s electrolytic manganese dioxide production accounted for approximately 73% of global production in 2018. China’s electrolytic manganese dioxide production is mainly concentrated in Guangxi, Hunan and Guizhou, with Guangxi’s production accounting for the largest proportion. According to the Huajing Industrial Research Institute, Guangxi’s electrolytic manganese dioxide production accounted for 74.4% of the national production in 2020.

1.5 Manganese sulfate: benefiting from increased battery capacity and concentrated production capacity

China’s manganese sulfate production accounts for approximately 66% of the world’s production, with production capacity concentrated in Guangxi. According to QYResearch, China is the world’s largest producer and consumer of manganese sulfate. In 2021, China’s manganese sulfate production accounted for approximately 66% of the world’s total; total global manganese sulfate sales in 2021 were approximately 550,000 tons, of which battery-grade manganese sulfate accounted for approximately 41%. The total global manganese sulfate sales are expected to be 1.54 million tons in 2027, of which battery-grade manganese sulfate accounts for approximately 73%. According to “A Brief Overview of Global Manganese Ore and China’s Manganese Product Production in 2020″ (Qin Deliang), China’s manganese sulfate production in 2020 was 479,000 tons, mainly concentrated in Guangxi, accounting for 31.7%.

According to Baichuan Yingfu, China’s high-purity manganese sulfate annual production capacity will be 500,000 tons in 2022. The production capacity is concentrated, CR3 is 60%, and the output is 278,000 tons. It is expected that the new production capacity will be 310,000 tons (Tianyuan Manganese Industry 300,000 tons + Nanhai Chemical 10,000 tons).

2. Demand for manganese: The industrialization process is accelerating, and the contribution of manganese-based cathode materials is increasing.

2.1 Traditional demand: 90% is steel, expected to remain stable

The steel industry accounts for 90% of the downstream demand for manganese ore, and the application of lithium-ion batteries is expanding. According to the “IMnI EPD Conference Annual Report (2022)”, manganese ore is mainly used in the steel industry, more than 90% of manganese ore is used in the production of silicon-manganese alloy and manganese ferroalloy, and the remaining manganese ore is mainly used in electrolytic manganese dioxide and manganese sulfate production of other products. According to Baichuan Yingfu, the downstream industries of manganese ore are manganese alloys, electrolytic manganese, and manganese compounds. Among them, 60%-80% of manganese ores are used to manufacture manganese alloys (for steel and casting, etc.), and 20% of manganese ores are used in production. Electrolytic manganese (used to produce stainless steel, alloys, etc.), 5-10% is used to produce manganese compounds (used to produce ternary materials, magnetic materials, etc.)

Manganese for crude steel: Global demand is expected to be 20.66 million tons in 25 years. According to the International Manganese Association, manganese is used as a desulfurizer and alloy additive in the form of high-carbon, medium-carbon or low-carbon iron-manganese and silicon-manganese during the production process of crude steel. It can prevent extreme oxidation during the refining process and avoid cracking and brittleness. It enhances the strength, toughness, hardness and formability of steel. The manganese content of special steel is higher than that of carbon steel. The global average manganese content of crude steel is expected to be 1.1%. Starting from 2021, the National Development and Reform Commission and other departments will carry out the national crude steel production reduction work, and will continue to carry out the crude steel production reduction work in 2022, with remarkable results. From 2020 to 2022, the national crude steel production will drop from 1.065 billion tons to 1.013 billion tons. It is expected that in the future China and the world’s crude steel output remains unchanged.

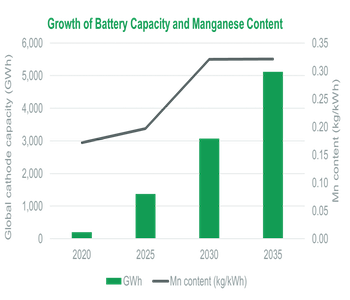

2.2 Battery demand: incremental contribution of manganese-based cathode materials

Lithium manganese oxide batteries are mainly used in the digital market, small power market and passenger car market. They have high safety performance and low cost, but have poor energy density and cycle performance. According to Xinchen Information, China’s lithium manganate cathode material shipments from 2019 to 2021 were 7.5/9.1/102,000 tons respectively, and 66,000 tons in 2022. This is mainly due to the economic downturn in China in 2022 and the continued price increase of upstream raw material lithium carbonate. Rising prices and sluggish consumption expectations.

Manganese for lithium battery cathodes: Global demand is expected to be 229,000 tons in 2025, equivalent to 216,000 tons of manganese dioxide and 284,000 tons of manganese sulfate. Manganese used as cathode material for lithium batteries is mainly divided into manganese for ternary batteries and manganese for lithium manganate batteries. With the growth of power ternary battery shipments in the future, we estimate that global manganese consumption for power ternary batteries will increase from 61,000 to 61,000 in 22-25. tons increased to 92,000 tons, and the corresponding demand for manganese sulfate increased from 186,000 tons to 284,000 tons (the manganese source of the cathode material of the ternary battery is manganese sulfate); driven by the growth in demand for electric two-wheeled vehicles, according to Xinchen Information and Boshi According to the high-tech prospectus, global lithium manganate cathode shipments are expected to be 224,000 tons in 25 years, corresponding to manganese consumption of 136,000 tons, and corresponding manganese dioxide demand of 216,000 tons (the manganese source of lithium manganate cathode material is manganese dioxide) .

Manganese sources have the advantages of rich resources, low prices, and high voltage windows of manganese-based materials. As technology advances and its industrialization process accelerates, battery factories such as Tesla, BYD, CATL, and Guoxuan High-tech have begun to deploy related manganese-based cathode materials. Production.

The industrialization process of lithium iron manganese phosphate is expected to be accelerated. 1) Combining the advantages of lithium iron phosphate and ternary batteries, it has both safety and energy density. According to Shanghai Nonferrous Network, lithium iron manganese phosphate is an upgraded version of lithium iron phosphate. Adding manganese element can increase the battery voltage. Its theoretical energy density is 15% higher than that of lithium iron phosphate, and it has material stability. A single ton of iron manganese phosphate The lithium manganese content is 13%. 2) Technological progress: Due to the addition of manganese element, lithium iron manganese phosphate batteries have problems such as poor conductivity and reduced cycle life, which can be improved through particle nanotechnology, morphology design, ion doping and surface coating. 3) Acceleration of the industrial process: Battery companies such as CATL, China Innovation Aviation, Guoxuan Hi-Tech, Sunwoda, etc. have all produced lithium iron manganese phosphate batteries; cathode companies such as Defang Nano, Rongbai Technology, Dangsheng Technology, etc. Layout of lithium iron manganese phosphate cathode materials; car company Niu GOVAF0 series electric vehicles are equipped with lithium iron manganese phosphate batteries, NIO has started small-scale production of lithium iron manganese phosphate batteries in Hefei, and BYD’s Fudi Battery has begun purchasing lithium iron manganese phosphate Materials: Tesla’s domestic Model 3 facelift uses CATL’s new M3P lithium iron phosphate battery.

Manganese for lithium iron manganese phosphate cathode: Under neutral and optimistic assumptions, the global demand for lithium iron manganese phosphate cathode is expected to be 268,000/358,000 tons in 25 years, and the corresponding manganese demand is 35,000/47,000 tons.

According to Gaogong Lithium Battery’s prediction, by 2025, the market penetration rate of lithium iron manganese phosphate cathode materials will exceed 15% compared to lithium iron phosphate materials. Therefore, assuming neutral and optimistic conditions, the penetration rates of lithium iron manganese phosphate in 23-25 years are respectively 4%/9%/15%, 5%/11%/20%. Two-wheeled vehicle market: We expect lithium iron manganese phosphate batteries to accelerate penetration in China’s electric two-wheeled vehicle market. Overseas countries will not be considered due to cost insensitivity and high energy density requirements. It is expected that under neutral and optimistic conditions in 25 years, lithium iron manganese phosphate will The demand for cathodes is 1.1/15,000 tons, and the corresponding demand for manganese is 0.1/0.2 million tons. Electric vehicle market: Assuming that lithium iron manganese phosphate completely replaces lithium iron phosphate and is used in combination with ternary batteries (according to the proportion of related products of Rongbai Technology, we assume that the doping ratio is 10%), it is expected that neutral and Under optimistic conditions, the demand for lithium iron manganese phosphate cathodes is 257,000/343,000 tons, and the corresponding manganese demand is 33,000/45,000 tons.

Currently, the prices of manganese ore, manganese sulfate, and electrolytic manganese are at a relatively low level in history, and the price of manganese dioxide is at a relatively high level in history. In 2021, due to dual energy consumption control and power shortage, the association has jointly suspended production, the supply of electrolytic manganese has decreased, and prices have risen sharply, driving the prices of manganese ore, manganese sulfate, and electrolytic manganese to rise. After 2022, downstream demand has weakened, and the price of electrolytic manganese has declined, while the price of electrolytic manganese dioxide has declined. For manganese, manganese sulfate, etc., due to the continued boom in downstream lithium batteries, the price correction is not significant. In the long term, the downstream demand is mainly for manganese sulfate and manganese dioxide in batteries. Benefiting from the increased volume of manganese-based cathode materials, the price center is expected to move upward.